Empowering Global Finance Through Tokenisation- Technology

Tokenising Real Assets. Unlocking Liquidity. Powering Investment Opportunities.

Debt • Private Equity • Equities • REITs • Patents • ESG • Carbon Credits • Sovereign Funds • Infrastructure • Natural Resources

Join 20,000+ Happy Earlier Users – Start Today!

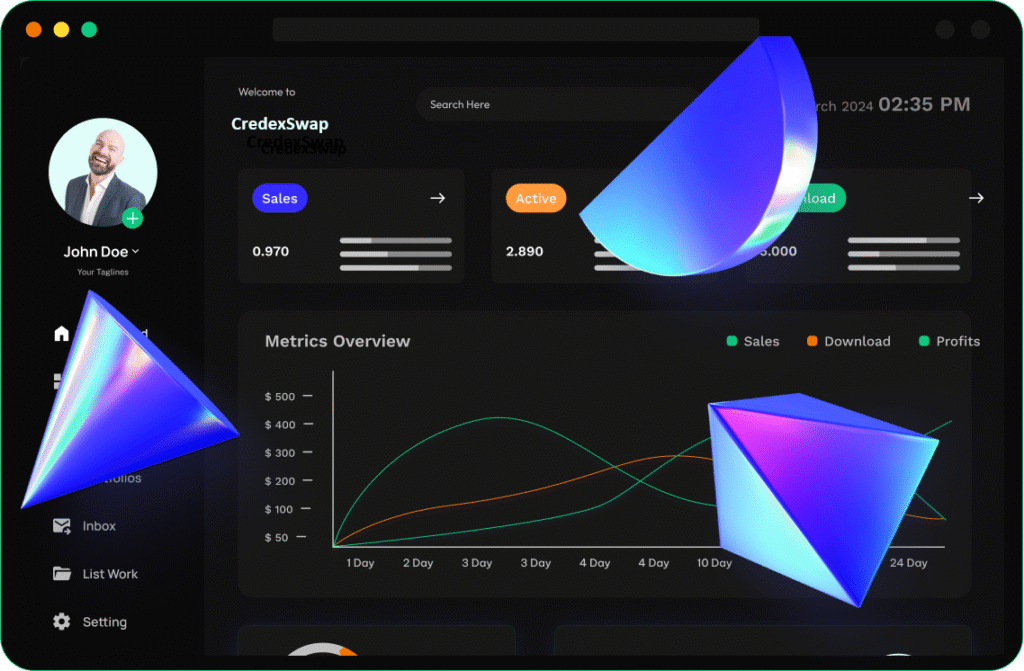

What is CredexSwap?

CredexSwap is a cutting-edge tokenisation platform and technology stack designed to digitise and transform the way the world invests in real-world assets.

We enable seamless tokenisation of complex financial instruments, providing access to capital markets, regulatory compliance, and global liquidity.

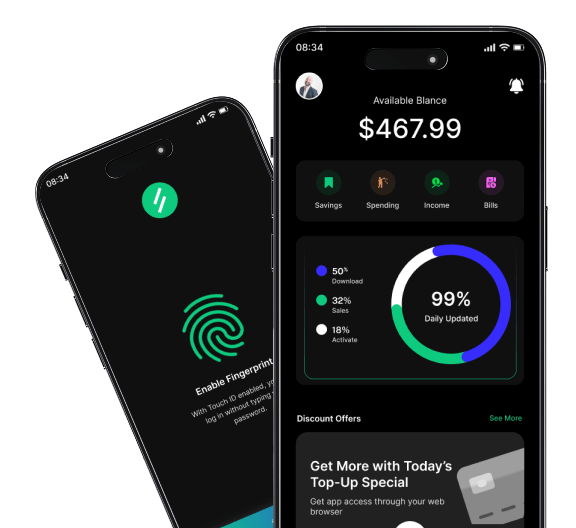

Our technology

CredexSwap is powered by ERC3643, the trusted tokenisation standard for real-world assets (RWAs).

With our full-stack platform, issuers can securely create, manage, and trade tokenised assets — unlocking new investment opportunities across global markets.

key Features

Identity-verified access via ONCHAINID

Full compliance with KYC/AML and investor restrictions

Customisable smart contract solutions for every asset class

Seamless integration with traditional finance and blockchain

EVM-compatible, auditable, and upgradable smart contracts

TOKENISATION

Assets We Tokenise

CredexSwap unlocks the tokenisation of a broad range of real-world financial assets:

- Debt: Diaspora bonds, trade receivables, SME credit

- Private Equity & Public Shares: Venture capital, pre-IPO stocks

- Real Estate: REITs, residential and commercial properties

- IP & Patents: Innovation assets, royalty streams, patents

- Sustainability: ESG-linked securities, green bonds

- Carbon Credits: Tokenising environmental assets and offsets

- Government Infrastructure Projects: Public-private partnerships, urban development

- Sovereign Funds: Government-backed investment pools

- Natural Resources: Commodities, mining assets, oil & gas projects

Who It’s For

CredexSwap serves a diverse ecosystem of issuers and investors:

- Governments & Sovereign Funds: Tokenising national assets, infrastructure, and sovereign-backed projects

- Private Equity & Fund Managers: Digitising portfolios, unlocking liquidity, expanding investor access

- Real Estate Developers: Launching tokenised REITs, fractional property ownership

- Corporate Innovators: Protecting and monetising intellectual property, licensing, royalties

- Climate & ESG Developers: Creating tokenised green and carbon credit assets

- Natural Resource Sector: Tokenising mining projects, energy assets, and natural resource revenues

- Exchanges & Capital Markets: Enabling token trading, secondary markets, and investment products

Features SERVICES

Transforming Finance with Tokenisation Technology

CredexSwap offers an array of features designed to empower financial markets in Africa and emerging economies:

Tokenisation of Diaspora Bonds

Through diaspora bond tokenisation, we allow countries to tap into the financial resources of their diaspora communities. These bonds can be easily issued, traded, and managed on the blockchain, ensuring enhanced liquidity and global accessibility. Tokenisation reduces traditional barriers to investment, empowering individuals and institutions alike.

Stock Market Tokenisation

CredexSwap brings stock market assets to the blockchain, enabling fractional ownership of stocks in publicly traded companies and private equity. This innovation gives investors in Africa and other emerging markets the opportunity to engage in global markets, while improving access to capital for businesses and startups.

On-Chain Real-World Assets

We facilitate the tokenisation of other real-world assets like loans, trade receivables, and invoices, creating new liquidity channels for businesses in emerging markets. This asset-backed tokenisation makes it easier for companies to raise capital and for investors to diversify their portfolios.

Smart Contract-Powered Risk Management

CredexSwap utilises smart contracts to manage risks and streamline processes. These contracts ensure automated compliance, transparency, and accuracy, reducing operational costs while providing better decision-making frameworks for investors.

Features and Benefits

Unlocking Investment Opportunities in Africa & Emerging Markets

With CredexSwap, we bring two critical asset classes to the blockchain: diaspora bonds and stock market equities. This allows African nations and emerging markets to unlock new sources of capital, create fractional ownership opportunities, and offer global investors access to high-growth regions.

Team

Team behind CredexSwap

Ibrahim Salifou

Founder – CEO

AI, Cyber & Space Tech Policy Consultant | Public Policy Lobbyist | Blockchain, FinTech & Digital Asset Governance Expert | FDI/FPI | Energy& Commodity Analyst|Economist|Mining Deals Hunter 🇧🇯🇨🇭🇯🇵🇳🇿

Dr Eileen Cheng

Co-Founder & Public Relations Manager

Will Ruilin Ji

Co-founder

Damian Crowe

Board Advisory – Chartered Accountant | Ex-Founder of Obillex

Dr. Roland Amoussou

Board Advisory – International Lawyer

Aboubakar A. DRAMANE

Capital & Financial Market Advisor

Dumisani Washington

Diaspora advisor

Founder, CEO at Institute for Black Solidarity with Israel

AMOUZOUNVI A. Didier

Chief Technical Officer